Buying your first home or car can seem like a monolithic task. The research that goes into finding the perfect one can take weeks, and then come to the financing questions. Uncertainty surrounding the buys of these incredibly important commodities can be incredibly nerve-wracking. But the underlying principles of these transactions are actually straightforward.

Understanding how to go into the buying process with your eyes wide open and your financial history strong will help make this process as painless as possible and get you the home or car that you’ve always dreamed of in no time.

Take great care of your financial health.

First time home buyers are getting older in Australia, and across the world. The average age of homeowners has risen to 34 and that trend appears to be continuing to progress. This means that we are renting for longer, but also have additional years to build wealth and savings in order to chase after a high-quality first home purchase.

With this additional time that the average homebuyer has to prepare, Australians must commit themselves to maintain fantastic financial habits in the months and years leading up to this life-altering event. In truth, the same qualities make for a smooth car buying experience too. As a general rule, you should always work to keep your credit score as high as possible, but this is especially true during the months leading up to a major purchase, whether it be a house or a car.

Seeking out car finance options is a great way to purchase your first vehicle and learn the ropes of big-ticket borrowing. With a car purchase, you will need to fork out a down payment as well as pass credit checks in order to satisfy the requirements set out by whichever financial institution you are receiving the auto loan from — a credit union, traditional bank, or private money lender.

Some dealerships even offer to finance for borrowers seeking to purchase with the help of a certain loan amount. In order to minimize your interest rate, it’s a great idea to start saving aggressively in the months leading up to the purchase. This shows that you will be a responsible caretaker and that you take financial health seriously. These conditions add up to a responsible borrower that lenders are willing to advance a line of credit to — and a new car for you!

Do Your Research

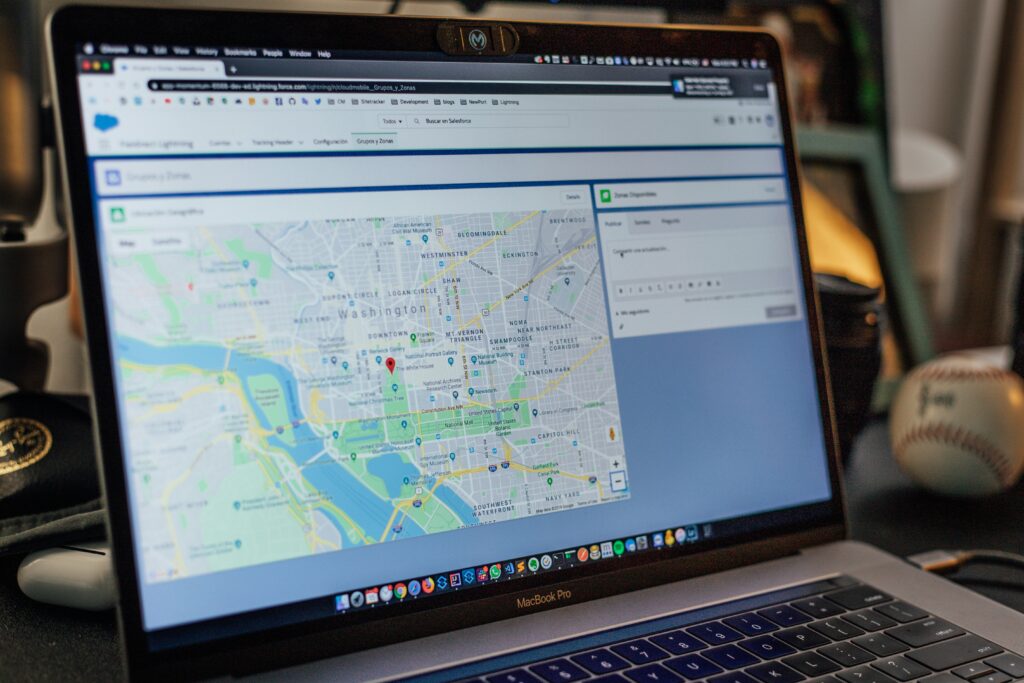

The same conditions prevail in the real estate market. A high-quality credit score and a dedication to saving will help your real estate agent and financial institution take you seriously as a first home buyer. But this isn’t where the preparation ends for those hoping to become homeowners. Homeownership requires a lot of upkeep and general know-how. But it’s also a waiting game. In order to find the perfect home, you need to view a number of properties in order to shorten your must-have list down to the essentials.

Beginning with the things that you can’t change about the home is a great start. If you like a quiet neighborhood with a great view of the night sky, then settling in a home that’s out of the city is a must. Likewise, if the walking distance from your child’s school is crucial, then you must pick from a list of properties that are within the range of educational facilities that meet your needs.

Many first-time homebuyers forget about these external essentials and focus all their attention on the kitchen layout or the number of bedrooms. These are important considerations as well, but the home can often be altered to suit your particular needs. Viewing properties before you are ready to pull the trigger on buying is a great way to weed out the things you think are important in a new home and separate out your true priorities.

Buying your first car or home is a big step, make sure you are ready for it.